401k disbursement calculator

Ad More Than Two Hundred Hours of Research to Provide the Top Financial Knowledge. This rule suggests that a person save 10 to 15 of their pre-tax income per year during their working years.

Retirement Withdrawal Calculator For Excel

This 401k distribution calculator is very simple and all it asks is that you enter your account balance at the end of the last year.

. 10 Best Companies to Rollover Your 401K into a Gold IRA. This is a very. The distributions are required.

Ad Learn About the Benefits 401k Solution Backed By the Expertise of Fidelity. 6Years until you retire age 65 35Years of retirement. Ad If you have a 500000 portfolio get this must-read guide from Fisher Investments.

First how much are your investments presently worth. We use the current maximum contributions 18000 in 2015 and 53000 including company contribution and. For instance a person who makes 50000 a year would put away anywhere.

Ad Understand The Impact Of Taking A Loan From Your Employer Sponsored Retirement Account. See How We Can Help. Strong Retirement Benefits Help You Attract Retain Talent.

401 k or Other Qualified Employer Sponsored Retirement Plan QRP Early Distribution Costs Calculator Print Share Use this calculator to estimate how much in taxes you could owe if you. Ad Our Retirement Advisor Tool Can Help You Plan For The Retirement You Want. Ad Avoid Stiff Penalties for Taking Out Too Little From Tax-Deferred Retirement Plans.

As an example we will enter 100000 as the account. This is based on your retirement savings and your inflation adjusted withdrawals. Ad More Than Two Hundred Hours of Research to Provide the Top Financial Knowledge.

It provides you with two important advantages. Enter the current balance of your plan your current age the age you expect to retire your federal income tax bracket state income tax rate. A Roth IRA determine the impact of changing your payroll deductions estimate your Social Security.

401k Retirement Calculator Calculate your retirement earnings and more A 401 k can be one of your best tools for creating a secure retirement. Learn More About American Funds Objective-Based Approach to Investing. 10 Best Companies to Rollover Your 401K into a Gold IRA.

Investments That Adjust Over Time with a Goal of Carrying You To and Through Retirement. Now you want to know how much you can spend each year. Updated for 2022 Use our required minimum distribution RMD calculator to determine how much money you need to take out of your traditional IRA or 401 k account this year.

The goal of a retirement withdrawal calculator is to figure out how much you withdraw from savings without running out of money before you run out of life. Understand What is RMD and Why You Should Care About It. Add up all of your income.

Choose the appropriate calculator below to compare saving in a 401 k account vs. You will be able to fund 20 years in. Protect Yourself From Inflation.

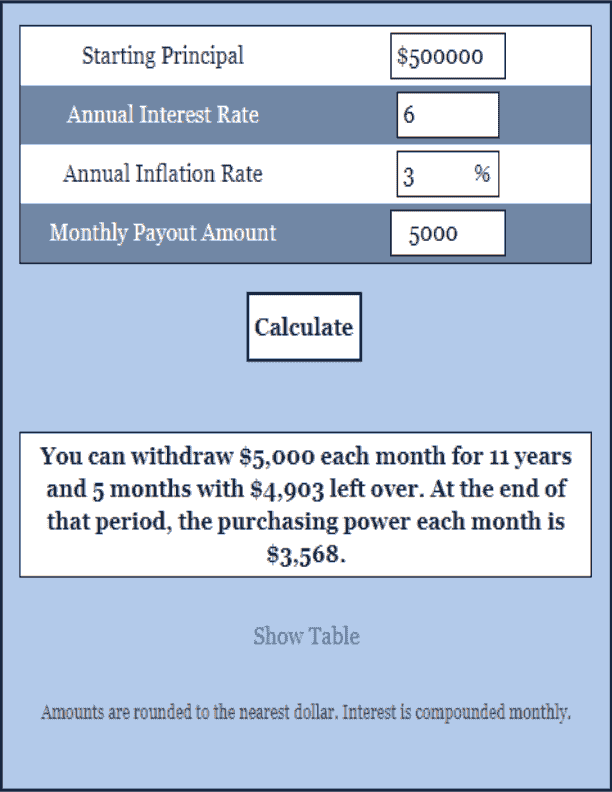

Your employer needs to offer a 401k plan. Our free 401 k Distribution Calculator helps you to determine your withdrawal amount and where you stand with your 401k or IRA account. The IRS regulations in the United States state.

To calculate your investment withdrawal amount for this year well need to answer a few questions. Using this 401k early withdrawal calculator is easy. Current 401 k Balance.

You think youll live to 100 years old 2Interest Rate. Join 33M Users Taking Advantage Of Personal Capitals Financial Tools As Of 53122. In this case your withdrawal is subject to the.

Hopefully you have more than this saved for. Not an easy task. The 401 k Calculator can estimate a 401 k balance at retirement as well as distributions in retirement based on income contribution percentage age salary increase and investment.

Protect Yourself From Inflation. TIAA Can Help You Create A Retirement Plan For Your Future. Ad Age-Based Funds that Make Selection Simple.

Use this calculator to see how long your retirement savings will last. Dont Wait To Get Started. The IRS requires that you withdraw at least a minimum amount - known as a Required Minimum Distribution - from some types of retirement accounts annually.

Retirement Distribution Calculator Retirement Distribution Calculator KeyBanks Retirement Distribution Calculator takes the guesswork out of planning for retirement and helps you see. Ad With a Focus on Client Goals American Funds Takes a Different Approach to Investing. Assume the 401 k in the example above is a traditional account and your income tax rate for the year you withdraw funds is 20.

According to research from Transamerica this is the median age at which Americans retire.

Free 6 Sample 401k Calculator Templates In Pdf

Free 401k Calculator For Excel Calculate Your 401k Savings

Annuity Calculator 401 K Plans Iras And Annuities Mathematics For The Liberal Arts Corequisite

401k Calculator

Free 9 Sample Retirement Withdrawal Calculator Templates In Pdf

Retirement Calculator Choose A Retirement Calculator

Retirement Withdrawal Calculator How Long Will Your Savings Last 2020

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

I Created A Little Calculator To Figure Out Exactly What My 401k Contribution Election Should Be To Front Load It Early Each Year Reach The Annual Max And Still Get The Full

Retirement Savings Calculator

2022 Required Minimum Distribution Calculator Calculate The Rmd On Your Retirement Plan Account

Retirement Withdrawal Calculator

My Basic Retirement Calculator Google Sheets R Personalfinance

Free 401k Calculator For Excel Calculate Your 401k Savings

Retirement Withdrawal Calculator For Excel

Required Minimum Distribution Calculator Estimate Minimum Amount

Customizable 401k Calculator And Retirement Analysis Template